A Beginner’s Guide To SOCIAL SECURITY – Rates & Benefits

- RetireOn

- Updated: May 20, 2022

Social Security is an essential part of retirement planning in the United States.

Here is a beginner’s guide to social security. This post will cover how much social security you can access, when you are eligible, and how the moment of claiming can influence the amount you receive. Plus, we will explore other important rules that you should be aware of.

Video Guide

Eligibility

Knowing when you are eligible to claim social security is fundamental to your retirement planning. You can start claiming social security when you turn 62 however you will not receive the full benefits.

You will only receive the full benefits when you reach Full Retirement Age (FRA) and this depends on when you were born which is explained in the table below.

| Year of Birth | Full Retirement Age |

| 1943 – 1954 | 66 |

| 1955 | 66 + 2 months |

| 1975 | 66 + 4 months |

| 1958 | 66 + 6 months |

| 1959 | 66 + 8 months |

| 1960 | 67 |

For the rest of this post we will assume that you were born in 1960 and therefore your full retirement age is 67.

Effects of Claiming Before Or After Full Retirement Age

If you claim your social security prior to your FRA, the table below illustrates what percentage of monetary benefits you will be able to access.

| Age | FRA Benefits % | Benefit Amounts |

| 62 | 70% | $1,400 |

| 63 | 75% | $1,500 |

| 64 | 80% | $1,600 |

| 65 | 86% | $1,733 |

| 66 | 93% | $1,866 |

| 67 | 100% | $2,000 |

| 68 | 108% | $2,160 |

| 69 | 116% | $2,320 |

| 70 | 124% | $2,480 |

A Case Study

Let’s assume that you receive $2,000 per month at your FRA which is 67. If you decide to claim after this age, your benefits will increase by 8% every year until you turn 70. After you reach this age, they will remain the same.

Thus, if you decide to wait until 70 to claim, you could have 124% more which equates to $2,480 or 480 dollars per month more.

On the other hand, if you decide to receive your social security earlier than your FRA, your benefits are reduced by about 6% each year. Thus, if you claim at 62, you will receive 70% of $1,400 which is a significant financial difference. Furthermore, this will influence the social security of your spouse.

Despite recognizing the benefits of waiting until your FRA, around 32% claim their social security at 62 according to the Social Security Administration (SSA). This may be due to the fact that people want to have money as early as possible and think that if they wait too long they will not benefit from it as they may die early.

How Much Social Security Will You Receive?

Your benefits are calculated based on your earnings’ history. This means that the Social Security Administration calculates your average indexed monthly earnings during the 35 years in which you earnt the most money.

The result of this calculation is called the primary insurance amount which is what you are entitled to claim when you reach your FRA.

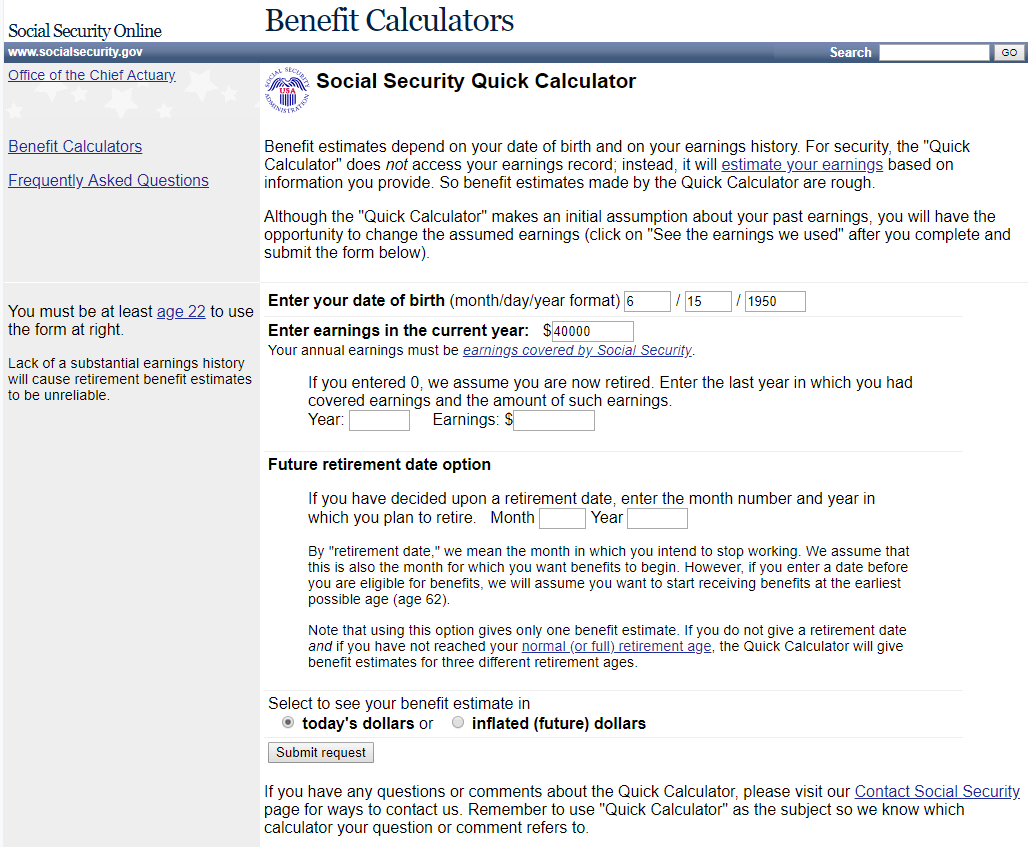

Calculators From The Social Security Administration

On the Social Security Administration website, you can find two types of calculators to estimate your benefits. One is a quick calculator that offers a rough estimation whilst the other is a full calculator which provides a more detailed estimate.

If you prefer to calculate your social security manually, the SSA also offers a spreadsheet which walks you through the process step by step. In order to get a better understanding of how the benefits are calculated, the spreadsheet shows and explains how your benefit estimate is calculated which is missing from the online calculator.

It’s key to remember there is a maximum that can be paid out which is $2,861 for 2019 according to the SSA.

Other Benefits And Rules To Consider

This section uses the information provided by Dana Anspach in ‘Control Your Retirement Destiny’ which explains other benefits and rules to consider in relation to social security.

Next to your personal benefits, you may be eligible for others such as Spouse benefits, Divorced benefits, and Survivor or Widow benefits. They all have their own rules when it comes to eligibility which is why exploring them further through the SSA links provided is worthwhile.

Furthermore, there are other factors which will determine how much SSA you can receive outside of the information we have already discussed. Firstly, a key determinant is if you are still working or not. If this is the case, there is an income limit that applies:

- If you are still working and under your FRA, the earning limit is $17,640. If you earn more, you are not eligible for benefits.

- In the year you reach your FRA, the limit is $46,920. However, the SSA only counts earnings before the month you reach FRA.

- At your FRA: your earnings no longer reduce your benefits.

There are many variables to consider for these additional benefits and understanding their rules can quickly become complicated and overwhelming which is why using advanced software can offer help and support.

Advanced Social Security Calculators

In ‘Control Your Retirement Destiny’, Dana suggests there are three useful software’s:

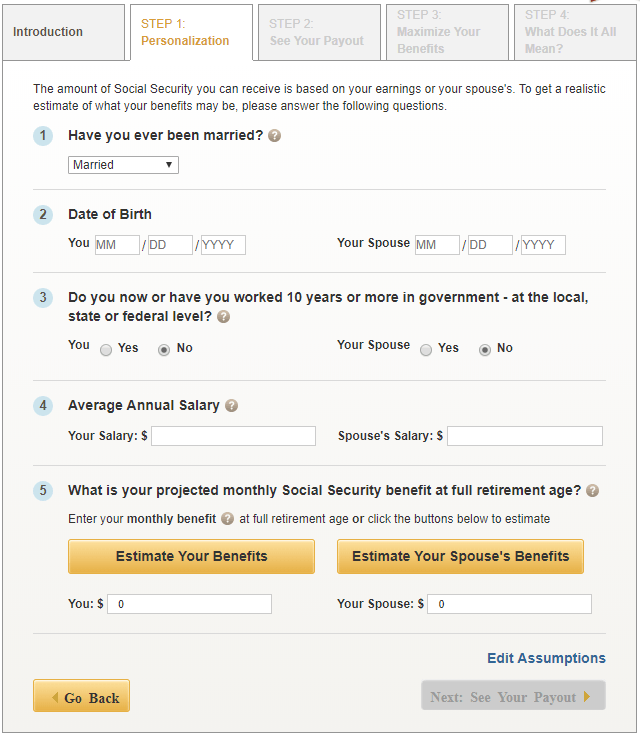

AARP Social Security Calculator

This calculator allows you to assess your claiming options. It does not explain the numbers leading to the final recommendation nor does it deliver more advanced claiming strategies.

Maximize My Social Security

This calculator covers a wide variety of possible claiming scenarios. This is a paid service ($40 per year for individuals and $250 for financial advisors). The following benefits of social security are considered in the calculator:

- Retirement Insurance Benefits

- Spouse’s Insurance Benefits

- Divorced Spouse’s Insurance Benefits

- Social Security Disability Insurance Benefits

- Child In-Care Spouse’s Insurance Benefits

- Widow(er)’s Insurance Benefits

- Divorced Widow(er)’s Insurance Benefits

- Child’s Insurance Benefits

- Childhood Disability Benefits

- Surviving Child’s Insurance Benefits

- Father’s and Mother’s Insurance Benefits

Social Security Timing

This software was designed by advisors for advisors. Thus, you will need to access an advisor if you would like to receive a full report. You will receive three claiming strategies. They also have a free calculator which simplifies information.

This calculator is also another paid service ($49.99 per month or $500 for an annual subscription). It is a very powerful and comprehensive social security calculator, which can serve as an essential tool for retirement/financial advisors.

Please subscribe to our YouTube Channel and our newsletter if you want to be notified when a new video or a post is released. You can also find us on Facebook.