5 Crucial Steps To Take Before Retirement

- RetireOn

- Updated: March 12, 2024

Most people see retirement is a new chapter in life. The way you prepare for it, the way you approach this part of your life will be determent whether you are looking forward to it or see retirement as something you are not sure about or something that makes you feel anxious.

In this article, I would like to introduce you to some of the options available, so that retirement can be the best chapter of your life yet. Specifically, I will discuss five different points that should be involved or a part of your retirement plan.

Step 1: Free Research

Before going into your in-depth retirement plan, you first need to get your general information collected, such as your income, expenses, assets, and retirement estimation on when to retire.

These are the most crucial questions that you would be asked if you were to meet with an adviser or to plan it by yourself.

Try Out Retirement Calculators or Planners

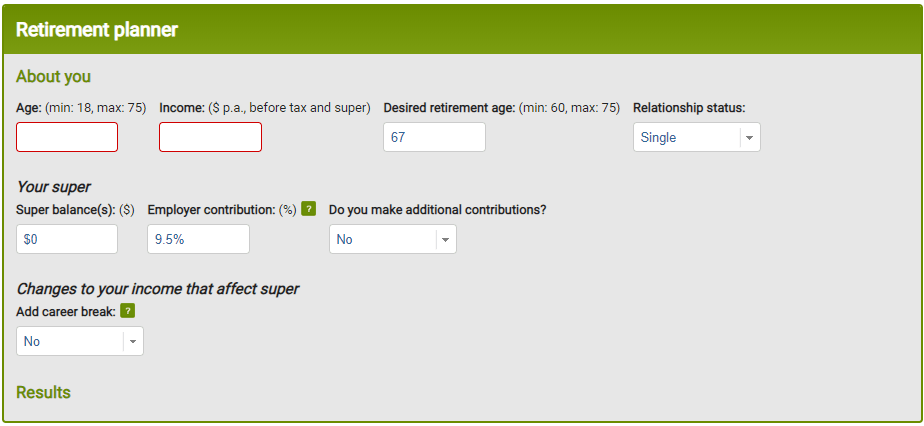

To get an overview, where you stand with your finances, you could use one of the online calculators. If you are located in Australia, Retirement Planner is the one provided by MoneySmart (the government organisation).

It takes various aspects into account and allows you to play around with the numbers to tell you how much money you will have available upon retirement.

If you are in the United States, I recommend smartasset. They offer a few different types of calculators – Retirement Calculator, 401k Calculator, and Social Security Calculator.

Utilise Your Retirement Funds For Advice

Another important step to take is to talk to your retirement funds (super funds in Australia, 401k or IRA funds in the US) to get advice and information about retirement.

Many of the retirement funds offer free advice services. You can talk about your expenses, savings, retirement income, and right withdrawal strategies during retirement.

Visit the Government Websites

You should also check government support to be knowledgeable on how much you will receive upon retirement. For example, in the USA, you will get much higher government support if you wait until you turn 70, compared with accessing the government support when you are at 65.

You can find more information about Social Security here: A Beginner’s Guide To SOCIAL SECURITY – Rates & Benefits

Step 2: Determine Living Style

You then need to decide on where and how you want to live after retiring. You need to consider whether you want to stay in your current home, move with family, sell your house and move to a retirement village or serviced apartment, or even living in a caravan for a while. How enjoyable and satisfactory your next step in life will be, depends significantly on the choices you make now.

Each of these options has advantages and disadvantages. Whatever your choice, make sure

- Healthcare is accessible

- Know what the taxes are at the new place

- The costs of living

To know the retirement costs of living in Australia, read our another article that provides you with practical insights: Retirement Costs In Australia – Can You Afford Them?

Step 3: Professional Assistance

After considering all of the information above, it is a good idea to seek help from a professional. A professional in retirement can help you in addressing boosting your savings, explaining how healthcare costs will change, contemplating how to change investment strategies, and providing advice on possible refinancing.

Where to find a professional retirement planner?

When you plan for your retirement, you want advice not just from anyone. After all, you are planning for your future life. Choose a retirement planner who has your best interest at heart.

You may be asking, “How do I find a good adviser?” In Australia,

- I recommend you to read “Choosing a Financial Adviser” page from MoneySmart because it offers plenty of information about how to choose your adviser and guidelines you should follow.

- If you are looking for ratings on specific advisers you have found, you can find them through AdviserRatings.

- Another useful website for finding financial advisers is the Financial Planning Association of Australia. If your chosen adviser has no license, think twice. Most likely, you do not want to put your retirement planning in this person’s hands.

Step 4: Healthy and Purposeful Life

When retiring, there are some general points to consider. In the United States, you will be eligible for Medicare. However, you need to do research and consider whether or not this will be enough. To do so, we suggest that you visit the Medicare website and look at the different options for health care.

In Australia, it is often very tempting to opt out of the private healthcare coverage because of the large expense required; however, that is not a wise decision as you will then be waiting extended periods of time to receive healthcare in the public systems.

Instead, you can ensure that you are only covered for what you need. To do so, you can visit the website PrivateHealth.gov.au which allows you to enter all of the things you need to be covered and suggests some providers.

Purposeful Life

If you were busy or have worked until retirement, having suddenly “nothing” to do can be a shock. Therefore, make plans to glide into retirement smoothly. Choose something you enjoy doing, something you can engage with, something that gives you purpose and direction.

For some, that might be getting the brush out to paint the painting you have had in your head for the last 20 years. For others, this might be writing a book, bringing your ideas alive on paper. Others might choose to generate a new stream of income.

If you choose the latter, nothing offers itself more than the internet. There are countless platforms where you can put all your skills to work, help others and find satisfaction at the same time.

Step 5: Learn How to Generate Extra Income

One thing you may want to do now is to find some way to make supplementary income in retirement. There are three key advantages to consider working and earning extra income. First, this will allow you to be more flexible in your retirement planning and also relieve stress from saving up massive amounts of money before retirement.

Second, it will provide you with a purposeful activity to fill up the free time you now have in retirement. When we suggest finding a new income, we are not referring to a full-time job but rather something you pick up when you’re available.

Third, it will give you peace of mind by providing you with extra money to cushion the blow of retirement.

You can find such an activity through various outsourcing sites and can do tasks such as proofreading. At fiverr, for example, you can do just about anything. It is worth visiting the website and seeing what are available and think about what you can offer.

Another option is to set up a passive income, which may require more skill, such as taking photos and uploading them to sites such as Shutterstock and iStock. You can also find more passive-income ideas for retirement here: 22 Amazing Passive Income Ideas For Retirement.

The five points discussed in this post are suggestions for you to make the retirement planning process easier. We hope this article was of some assistance to you on your retirement journey!